Section 179 Deduction Vehicle List 2025

Section 179 Deduction Vehicle List 2025. Section 179 qualified financing available in your company name. Section 179 deduction vehicle list 2023;

Section 179 tax deductions on vehicle purchases. The tax cuts and jobs act made changes to section 179 and bonus depreciation that remain in effect for 2025.

Section 179 Deduction Vehicle List 2025 Images References :

Source: qtemfg.com

Source: qtemfg.com

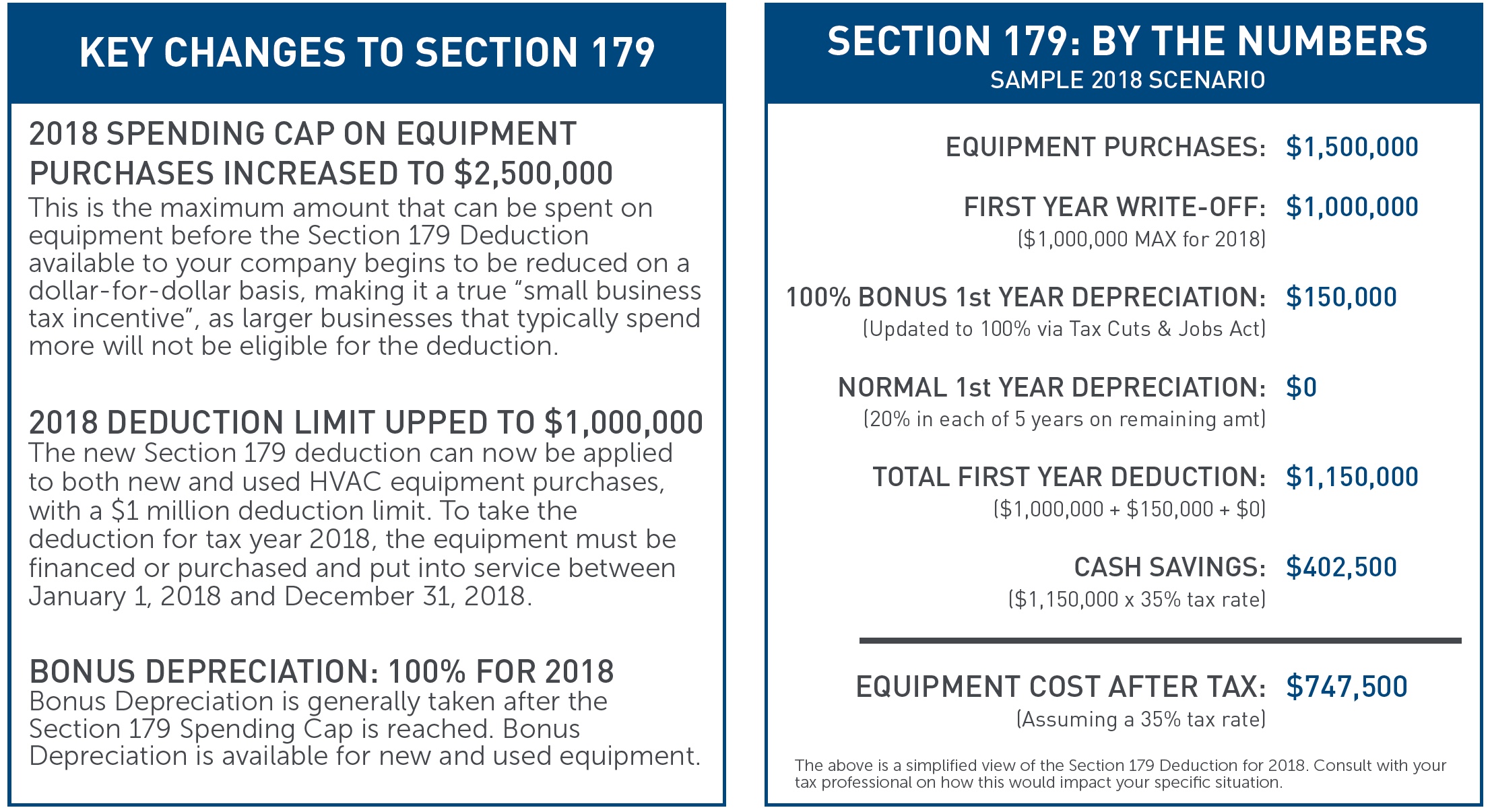

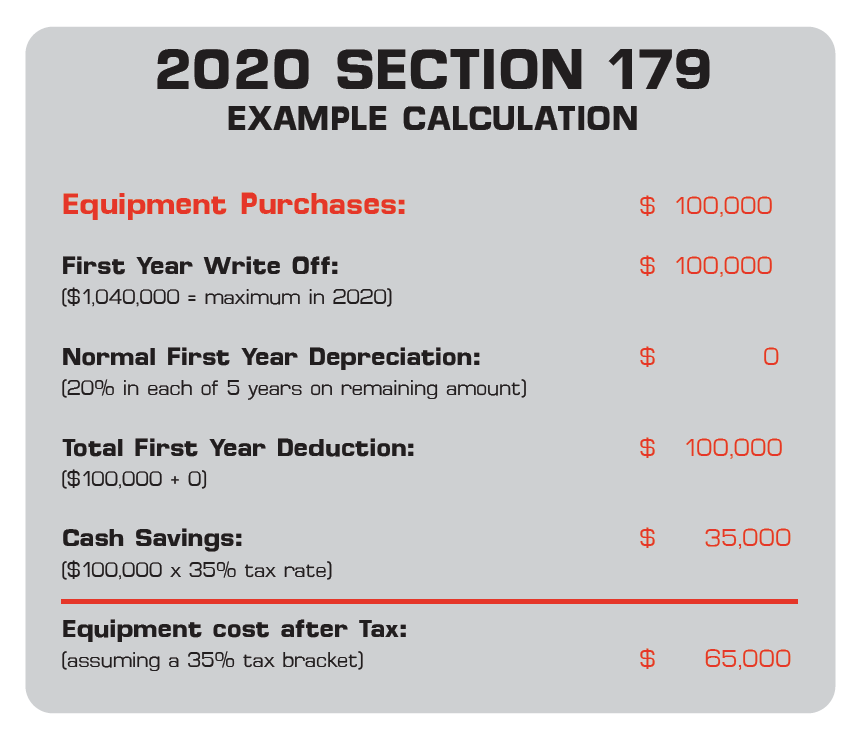

2022Section179deductionexample QTE Manufacturing Solutions, For 2022, there is a maximum deduction of $1,080,000, and the total value of the property purchased limit is set to $2,700,000.

Source: es.scribd.com

Source: es.scribd.com

CHRYSLER COMMERCIAL VEHICLES Section 179 Deduction Options, In 2025 (taxes filed in 2025), the section 179 deduction is limited to $1,220,000.

Source: www.coffmangmc.com

Source: www.coffmangmc.com

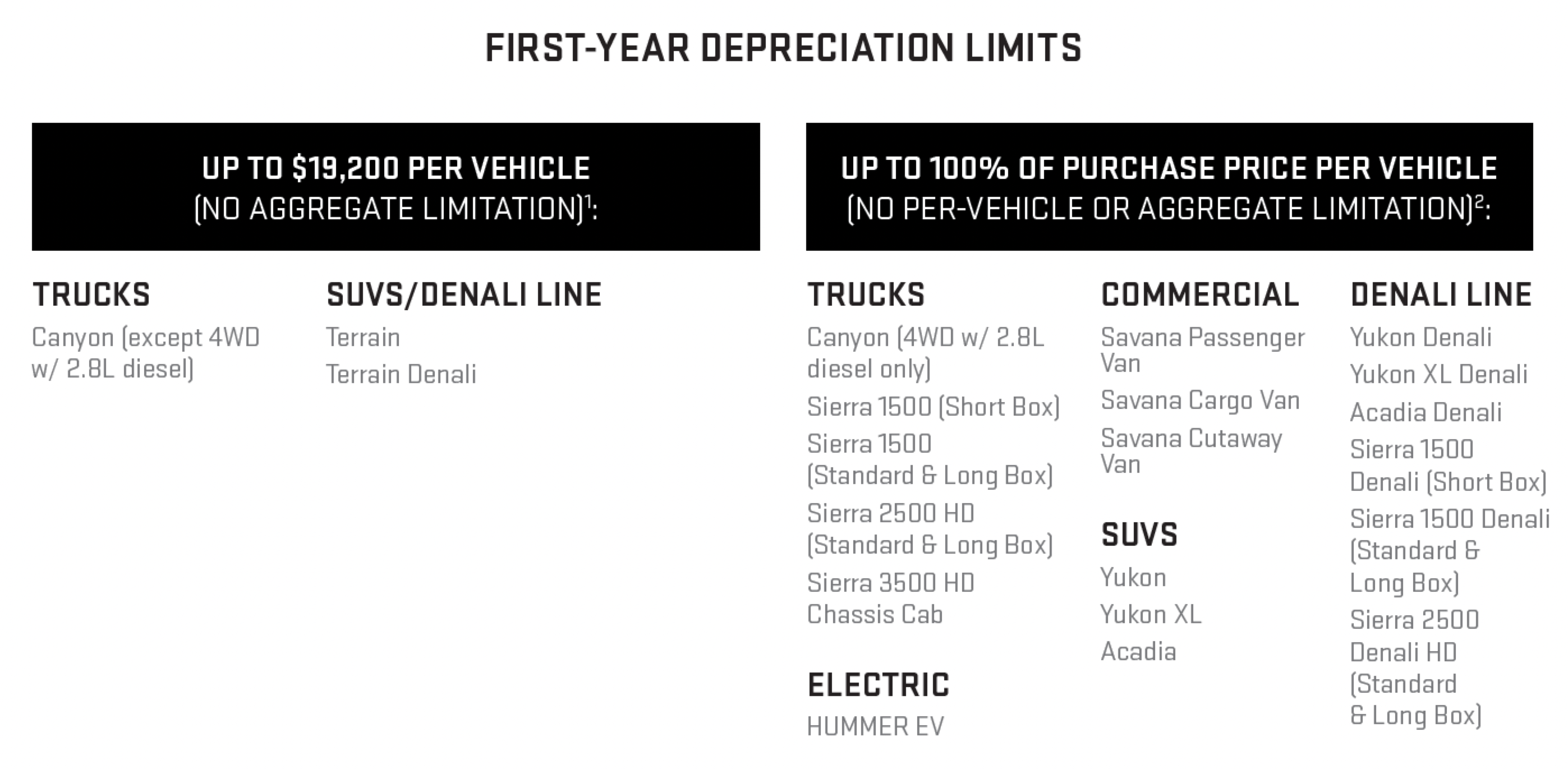

Understanding The Section 179 Deduction Coffman GMC, Section 179 tax deductions on vehicle purchases.

Source: airforceone.com

Source: airforceone.com

CHANGES TO IRS SECTION 179 WHAT IT MEANS FOR FACILITY OWNERS Air, Work trucks, suvs, specialty business use.

Source: www.sstlift.com

Source: www.sstlift.com

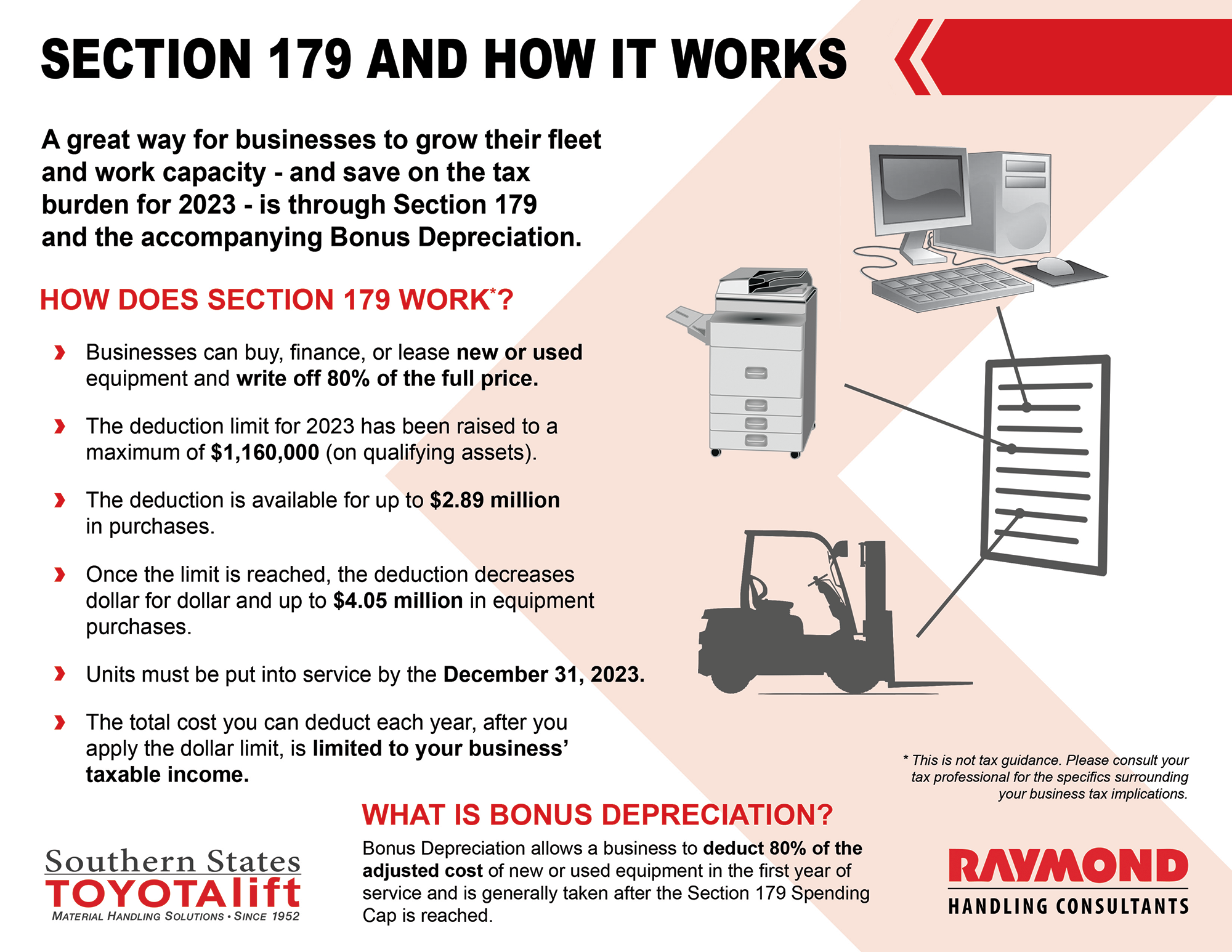

Using the Section 179 Tax Deduction for New Forklift Purchases in 2022, Section 179 allows different types of vehicles to qualify for the deduction.

Source: vermeerallroads.com

Source: vermeerallroads.com

Section 179 Tax Deduction, The tax cuts and jobs act made changes to section 179 and bonus depreciation that remain in effect for 2025.

Source: greenstar-us.com

Source: greenstar-us.com

Section 179 Tax Deductions Infographic GreenStar Solutions, Vehicles with a gross vehicle weight rating of 6,000 pounds or more may qualify for tax incentives, such as the section 179 deduction, if they meet specific criteria including business usage and purchase and placement into service within the applicable tax year.

Source: www.prestonmotor.com

Source: www.prestonmotor.com

Section 179 Tax Deduction How to Qualify Learn More, Section 179 deduction dollar limits.

Source: lsindustries.com

Source: lsindustries.com

New Equipment Purchase Tax Deductions Section 179 LS Industries, In 2025, the section 179 deduction limit has been raised to $1,220,000 ( an increase of $60,000 from 2023 ).

Source: universal-nissan.com

Source: universal-nissan.com

Section 179 Small Business Tax Deduction Universal Nissan, These vehicles qualify for section 179 & bonus depreciation